The new industry standard in legacy planning and support through loss

Beneficiaries face massive logistical and emotional challenges that follow the loss of a loved one. Life insurance carriers can empower policyholders to secure their financial futures and support beneficiaries with all that comes next.

12.5

months on average for families to resolve their loved one’s affairs, working 20 hours a week

78%

of beneficiaries struggle with financial matters related to the estate

47%

of beneficiaries say that their work performance was negatively affected by loss

98%

of beneficiaries are not converted into policyholders, a missed opportunity to build generational loyalty

Trusted by leading carriers of all sizes

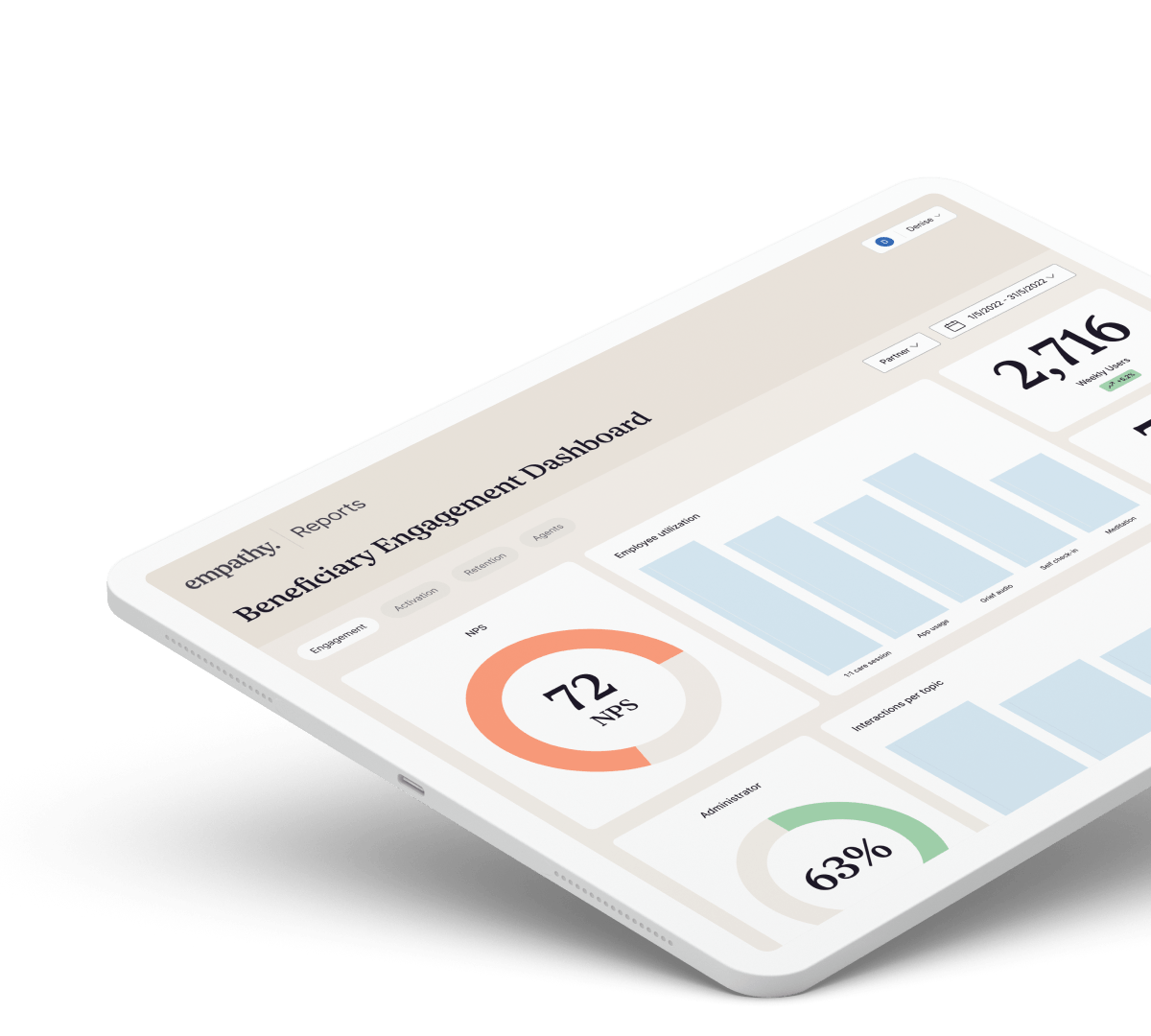

45M+

policyholders are covered by Empathy’s beneficiary care

3X

more beneficiaries turn into high-intent leads, compared with the industry standard

4.8/5⭑

average user rating after a session with a Care Manager

35%

reduction in claims operations costs due to cutback in calls

Going above and beyond for beneficiaries truly helps everyone

Unmatched carrier track record

Easy implementation

Simple, no-code implementation and straightforward contracting & billing

Hassle-free enrollment

Turnkey marketing and consistently high utilization rates

Quick start

Confidently launch in under 60 days by leveraging best practices from hundreds of deployments